8/28/2020

BY: GEORGE SINGOS

I have met with many business leaders who believe they are more profitable than they really are. In evaluating gross margin, or the difference between revenue and Cost of Goods Sold (COGS), they assume all their parts or assemblies are more profitable than reality. However, this perspective fails to account for overhead costs that are not properly utilized.

I have met with many business leaders who believe they are more profitable than they really are. In evaluating gross margin, or the difference between revenue and Cost of Goods Sold (COGS), they assume all their parts or assemblies are more profitable than reality. However, this perspective fails to account for overhead costs that are not properly utilized.

Failing to consider overhead costs gives managers an inaccurate idea of how their business is performing. To correctly calculate these expenses and profits, they must first understand what exactly these costs involve.

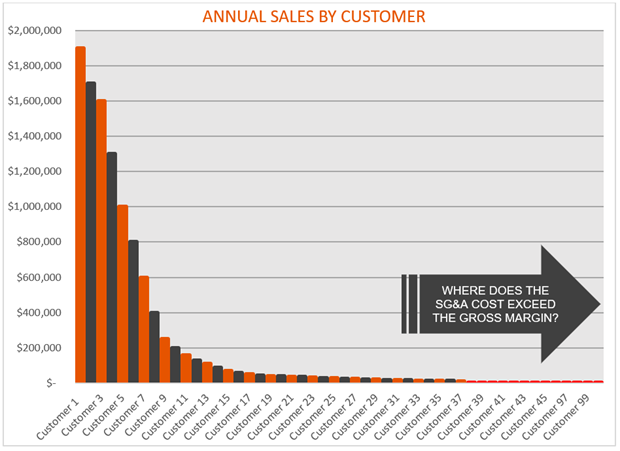

The graph below represents annual sales generated by customers at a company.

Following the 80/20 rule, larger customers, those on the left, represent 80% of the revenue while being only 20% of the customers. The customers on the far right represent 20% of the revenue, while being 80% of the customers. To better understand the true profitability of these sales, let’s consider a sample project sold to a customer on the right side of the graph.

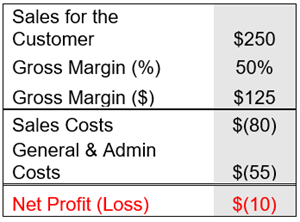

A small, one-hour job is sold to a customer for $250. The COGS for the job is $125 so the gross profit is 50% at $125. At first glance, this may appear profitable. However, this does not consider all overhead costs, or Selling, General and Administrative (SG&A) expenses, associated with the sale as shown in the calculation below. This includes paying the sales team to sell the order ($80) and administrative costs to process the order ($55). With these costs subtracted from the sale, the business has now lost money (-$10).

By understanding and evaluating these additional costs behind the sale, companies may find some of their customers are not generating the profits they initially thought – in fact, some are costing the business money. Once these customers have been identified, what can companies do to improve their profits?

HOW TO EVALUATE PROFITABILITY IN YOUR BUSINESS

The solution will likely be different for each company and customer depending on several factors. One of the concepts we explore is “trimming the tail”.

If the company decides a customer’s business is costing them too much money and not worth maintaining the relationship, it might make sense to discontinue working with them. This typically involves ending relationships with those customers toward the right side of the graph above, or essentially “trimming the tail.” While it may seem counter-intuitive to turn away business, this potentially can increase the company’s profitability. For example, if total company revenue is decreased from $10M to $9.5M after trimming the tail, while the gross margin increases from $1M to $1.5M, the company will have improved gross margin by 6.6%. Many companies do this with an activity-based costing model which allocates overhead costs to specific parts/assemblies and customers.

Aside from trimming the tail, other options include:

- Raising prices – It may be necessary to raise prices to cover all overhead costs. If the company does not wish to cut ties with a customer, this is one way to maintain the relationship while generating more profits. There are typically two outcomes that result from raising prices, both of which increase profitability:

- The customer agrees to pay the higher price, leading to higher profitability

- The customer does not agree to pay the higher price because you have outgrown their business, and they are now hindering your profitability; therefore, your profits will improve without their business

- Doing nothing – In some instances, there may be a strategic benefit in not doing anything in the short-run. If a certain customer only has smaller projects now but there is a potential for larger projects in the future, it is likely worth it for the company to maintain business with the customer and maintaining prices in order to win these opportunities down the line. Though many customers may dangle future business for a potential larger piece of the purchasing pie, many times this does not come to fruition.

When net profitability is the main focus of companies, managers get a more accurate idea of how the business is performing. This is even more critical today as some struggle to maintain their businesses during the COVID-19 pandemic. Now is the time for companies to evaluate revenue streams in this way and see where opportunities to maximize profits may lie.

For assistance with assessing your profitability, The Center’s experts can help. Contact inquiry@the-center.org or visit the-center.org for more information.

MEET OUR EXPERT

George Singos, Business Leader Advisor

George Singos, Business Leader Advisor

George Singos is the Business Leader Advisor for the Michigan Manufacturing Technology Center. He has more than 30 years of manufacturing experience in various capacities. For the past 20+ years, he has focused on sales and marketing management both domestically and internationally. Prior to joining The Center, George spent the previous 10 years working in International Business Development. His primary focus was growing International Sales in Europe and East Asia while supporting North American, South American and ASEAN operations.

Since 1991, the Michigan Manufacturing Technology Center has assisted Michigan’s small and medium-sized businesses to successfully compete and grow. Through personalized services designed to meet the needs of clients, we develop more effective business leaders, drive product and process innovation, promote company-wide operational excellence and foster creative strategies for business growth and greater profitability. Find us at www.the-center.org.

Categories: Finance,

growth