4/10/2015

BY: ROGER TOMLINSON

Many manufacturers determine a standard cost for their goods, services, and the production components they purchase throughout the year. Purchase Price Variance (PPV) is used to show the difference between the standard cost and actual cost in accounting.

NEGATIVE PURCHASE PRICE VARIANCE

I have a negative Purchase Price Variance. Does this mean I have made more profit? Well…Hold on. I’m not so sure! To calculate an item's PPV, subtract the standard cost from the actual cost. Sometimes you’ll end up with a positive PPV, while other times the PPV value will be negative. A positive PPV means the goods cost more than your standard cost, meaning the cost of goods has increased. A negative PPV means the goods actually cost less than your standard cost, leading you to believe that a negative PPV equals a larger profit. However, what is the true cost really?

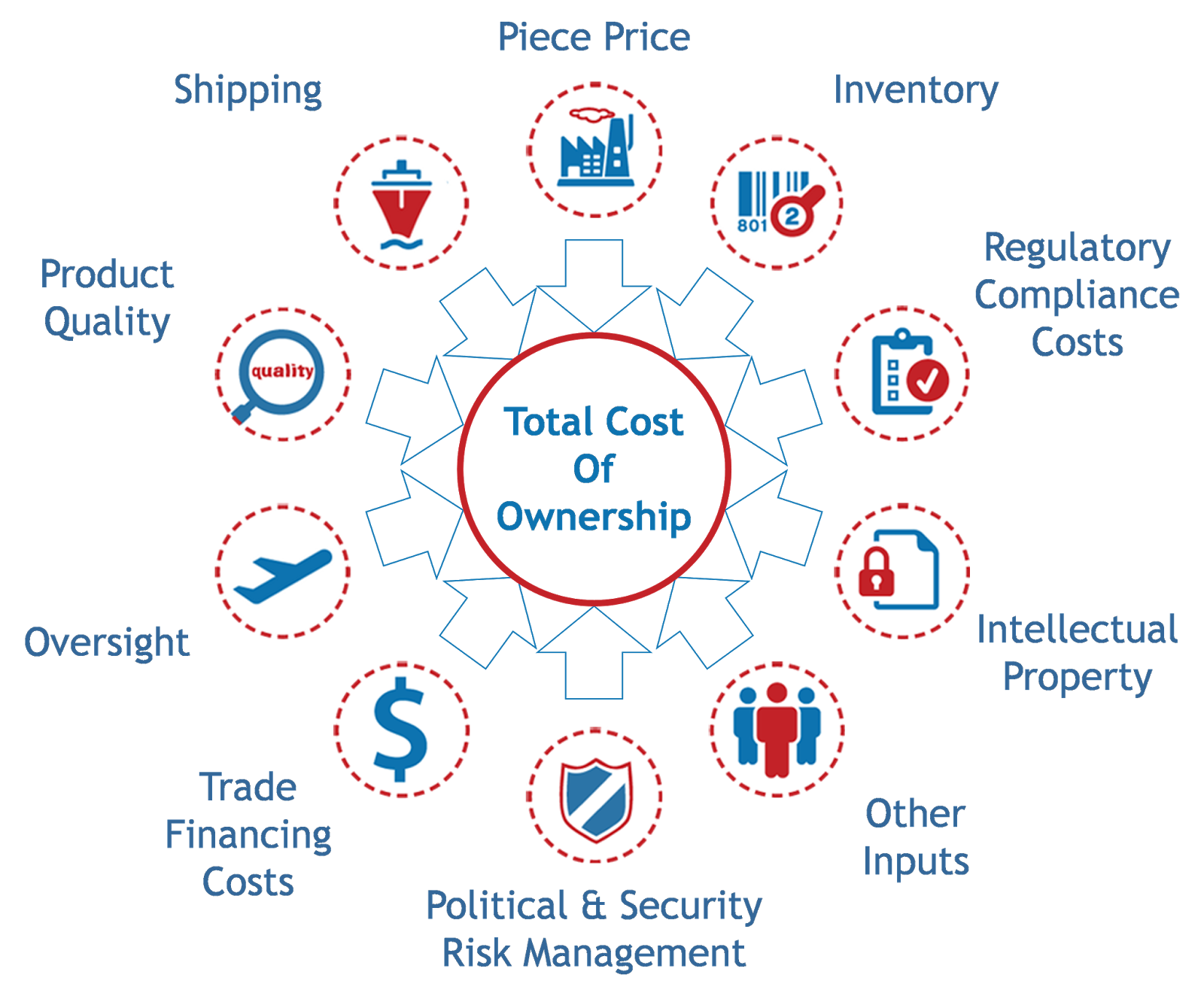

TOTAL COST OF OWNERSHIP

Total Cost of Ownership (TCO) is a concept that examines all of the costs related to the acquisition, transportation, and storage of products within the supply chain. How is it different than the way we have always looked at supplier prices? Traditional costing methods such as Purchase Price Variance (PPV) typically miss between 20-40 percent of the actual costs of acquisition. These methods only take into account the price for which the supplier is willing to sell the item. It usually includes the supplier’s manufacturing costs, overhead costs, and profit, but it may or may not include factors such as your costs for transportation and many other associated costs to bring the product to your location such as:

Shipping Costs

International multimodal transport costs and complexity tend to increase with distance. There is a potential cost for each transfer, inspection, storage and documentation requirements associated with each mode and country involved. A company importing goods must comply with a range of U.S. government requirements as well as the export regulations of the country of origin. Upon arrival in the United States, arrangements must be made to file entry documents at the port of entry, pay the estimated import duties, and secure the release of the goods from U.S. Customs and Border Protection. Companies often employ agents or brokers to assist them with these tasks. Each step in this chain of events involves costs that are often missed when determining the true cost of a product.

Shipping Time / Inventory

Shipping time has a direct impact on cost required to carry sufficient buffer inventory to cover customer demands until replenishment inventory arrives. Costs involve not only the dollar value of the inventory itself, but also the financing cost of the investment and carrying costs related to storing excess inventory.

Quality Costs

Quality cost issues result from increased travel and oversight time to control, mitigate or resolve the quality issues for off shore suppliers. Low quality issues can result in increased inspection, unhappy customers, product returns and shortages, and possible legal liability.

Supplier Oversight

Executives and other employees may need to travel to further develop or strengthen relationships. These employees may oversee design, production, or shipping or resolve unforeseen issues like supply chain disruptions or production errors.

Currency Fluctuation

When purchasing products from a foreign country in their native currency, the history of currency fluctuation must be taken into consideration. As an example, the price may be quoted for an annual contract, but during the year currency value versus the U.S. dollar may have changed making the price higher in U.S. dollars. In order to protect against currency fluctuation, you may choose to purchase a position on the foreign currency at the present price.

Intellectual Property

Protecting intellectual property (IP) rights is often a necessary step in both the U.S. and foreign markets. IP is any product of the human intellect that the law protects from unauthorized use by others. For small and medium companies, protecting IP rights in the U.S. is easier than in most overseas jurisdictions.

Payment Terms

Payment terms may be important to your choice of sources. Having to purchase a letter of credit or payment in advance requires financing and other costs prior to the availability of product for sale such as taxes, surety bond premiums, customs broker fees, and storage expenses.

The MMTC provide clients with Supply Chain education through group training and on site mentoring including Leadership Overviews (MIT Beer Game), Supply Chain Assessment, Supply Chain Executive Strategic Planning, Partner Engagement and Development, Risk Management and Total Cost of Ownership. For more information on MMTC's consulting services related to Total Cost of Ownership and Supply Chain Management, call MMTC at 888.414.6682 or visit www.mmtc.org.

Categories: Finance,

Supply Chain